Update on ICICI Prudential Energy Opportunities Fund

What has happened in the Energy space?

1. Economy activity has slowed down

2. Power demand has started to moderate – seasonality, better monsoon and winters & lower industrialactivity

3. Oil & Gas sentiments impacted due to Global/ local reasons – Trump imposing sanctions, delay in giving LPG subsidy, subdued global demand, worries around state elections,Gas sector allocation hit, rupee depreciation

4. Govt’s lower budgetary provisions (railways and infra) for FY26 has impacted the Capital Goods sectorwhile energy capex is on-going at the samepace

5.Weak sentiments in the PSU space and Energy themeis well represented by PSUs

6. Earningsmomentumis slowing down and overallmarket sentiments turning negative

7. Heavy FII selling –major brunt faced by Energy theme.

Data Source: Yes Securities

Why Energy is A long-term structural story

1. India’s growth and power demandis correlated

2. Energy demand can growdue to lifestyle changes happening

3. Factors in play for the energy theme: a) Manufacturing push b) Premiumization, c) Climate changes etc.

4. Energy is an important catalyst for newage technologies

5. Govt. reforms are a major driver for the energy theme

Update on ICICI Prudential Energy Opportunities Fund

Current Investment Thesis

1. Tactically managing the stocks

2. Energy sector gets impacted by Global and domestic business cycle and hence agility has to be the key

3. Current Portfoliohas a defensive approachtonavigate current volatility

4.Market-capwise, the portfolio is biased towards large-capstocks

5. The portfolio is diversified across sub themes (Eg: Oil exploration, Oil marketing, Power Generation, Power transmission, Cap goods etc.) based on valuation comfort as there has been good correction in these themes

Way- Forward

1. Portfolio is likely to continue hold good defensive position to tide over the volatility andwith the aim to outperformthebenchmark.

2. Portfolio can be more biased towards large caps

3. Power demand is showing signs of revival. Thus have increased allocation towards the same

4. Oil & Gas sector is one of the most under-owned sector and there has been huge FII selling here – thus any positivity around earnings (usually earnings revive over time as

these are cyclical companies) can be positive for the companies

5. Valuations of capital goods companies in the energy space have corrected and now presenting opportunityto increase allocation

6. We continue to remain positive for the theme, due to future triggers and valuation comfort.

Update on ICICI Prudential Energy Opportunities Fund

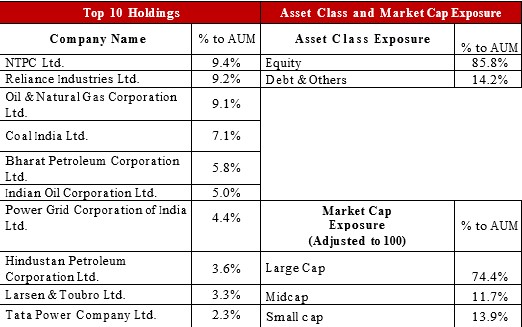

Current Portfolio Positioning

Data as on Jan 31,2025. The sector(s) /stock( s) mentioned in this slide do not con stitute any recommendation and ICICI Prudential Mutual Fund may or may not have any future position in these sector(s)/stock(s). The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the scheme. Please refer to the SID for investment pattern, strategy and risk factors. The asset allocation and investment strategy will be as per Scheme Information Document.

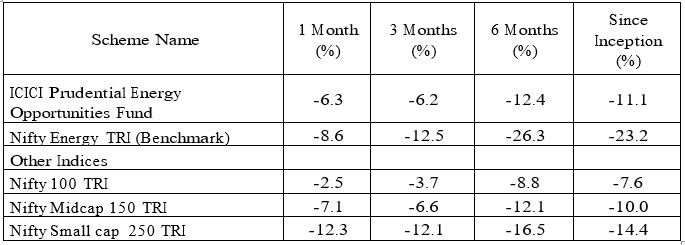

Performance Update

Returns are cal culated as on February 20, 2025. Past performance may or may not be sustained in future. Returns <1Y in absolute terms. Inception Date July 22, 2024. Source: Ace MF. For more information on Scheme Performance, click here.

Update on ICICI Prudential Energy Opportunities Fund

Riskometers & Disclaimer

Note:

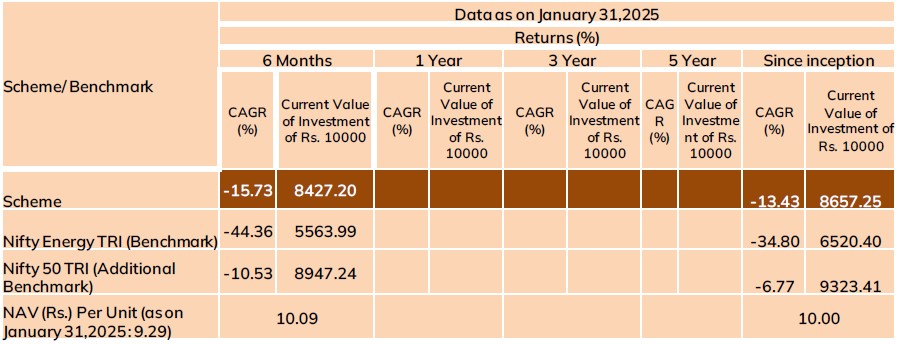

1. Simple annualized returns have been provided as per the extant guidelines since the Scheme has com pleted 6 months but not 1 year. However, such returns may not be representative. Absolute returns of the Scheme for the 6 month period is -7.93%.

2. Different plans shall have different expense structure. The performance details provided herein are of ICICI Prudential Energy Opportunities Fund.

3. The scheme is currently m anaged by Sankaran Naren, Nitya Mishr a and Sharmila D’mello. Mr. S ankaran Naren has been managing this fund since July 2024. Total Schemes managed by the Fund Manager is 15 (15 are jointly managed). Ms. Nitya Mishra has been managing this fund since Nov 2024. Total Schemes managed by the Fund Manager is 5 (5 are jointly managed). Priyanka Khandelwal has been m anaging this fund since July 2024. Total Schemes managed by the Fund Manager is 5 (4 are jointly m anaged) Ms. Sharmila D’mello has been managing this fund since July 2024. Total Schemes managed by the Fund Manager is 9 (9 are jointly manage d). Refer anne xure from pa ge no. 113 to 11 7 performance of other schemes currently managed by Sankaran Naren, Dharmesh Kakkad, Priyanka Khandelwal and Sri Sharma.

4. Date of inception: 22-Jul-2024.

5. Past performance may or may not be sustained in future and the same may not necessarily provide the basis for com parison with other investment.

6. Load is not considered for computation of returns.

7. In case, the start/end date of the concerned period is a nonbusiness date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period

8. The performance of the scheme is benchmar ked to the Total Return variant of the Inde x.

9. For performance of other schemes managed by the Fund Managers, please refer to the from page no. 113 to 117 of the factsheet

10.The returns shown above are of regular growth plan

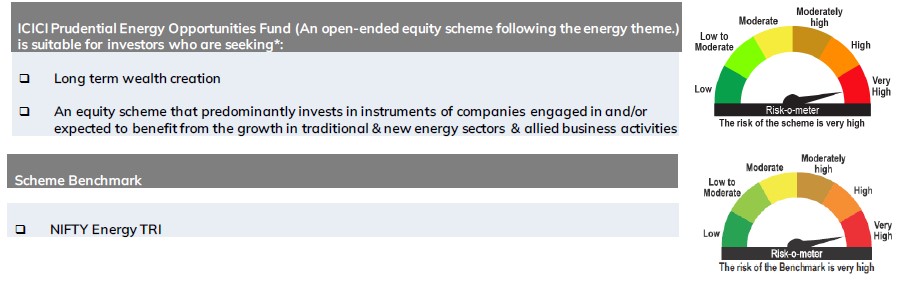

Riskometers

Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis. The above riskometers are as on Jan 31, 2025.

Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details

Update on ICICI Prudential Energy Opportunities Fund

Disclaimer

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

All figures and other data given in this document are dated as of Jan 31, 2025 unless stated otherwise. The same may or may not be relevant at a future date. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Prudential Asset Management Company Limited (the AMC). Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund

Disclaimer: In the preparation of the material contained in this document, the AMC has used information that is publicly available, including information developed in-house. Some of the material(s) used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. ICICI Prudential Asset Management Company Limited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise. The recipient alone shall be fully responsible/are liable for any decision taken on this material